Prices have gone up at their fastest rate in nearly 30 years - but there is worse to come, experts have warned.

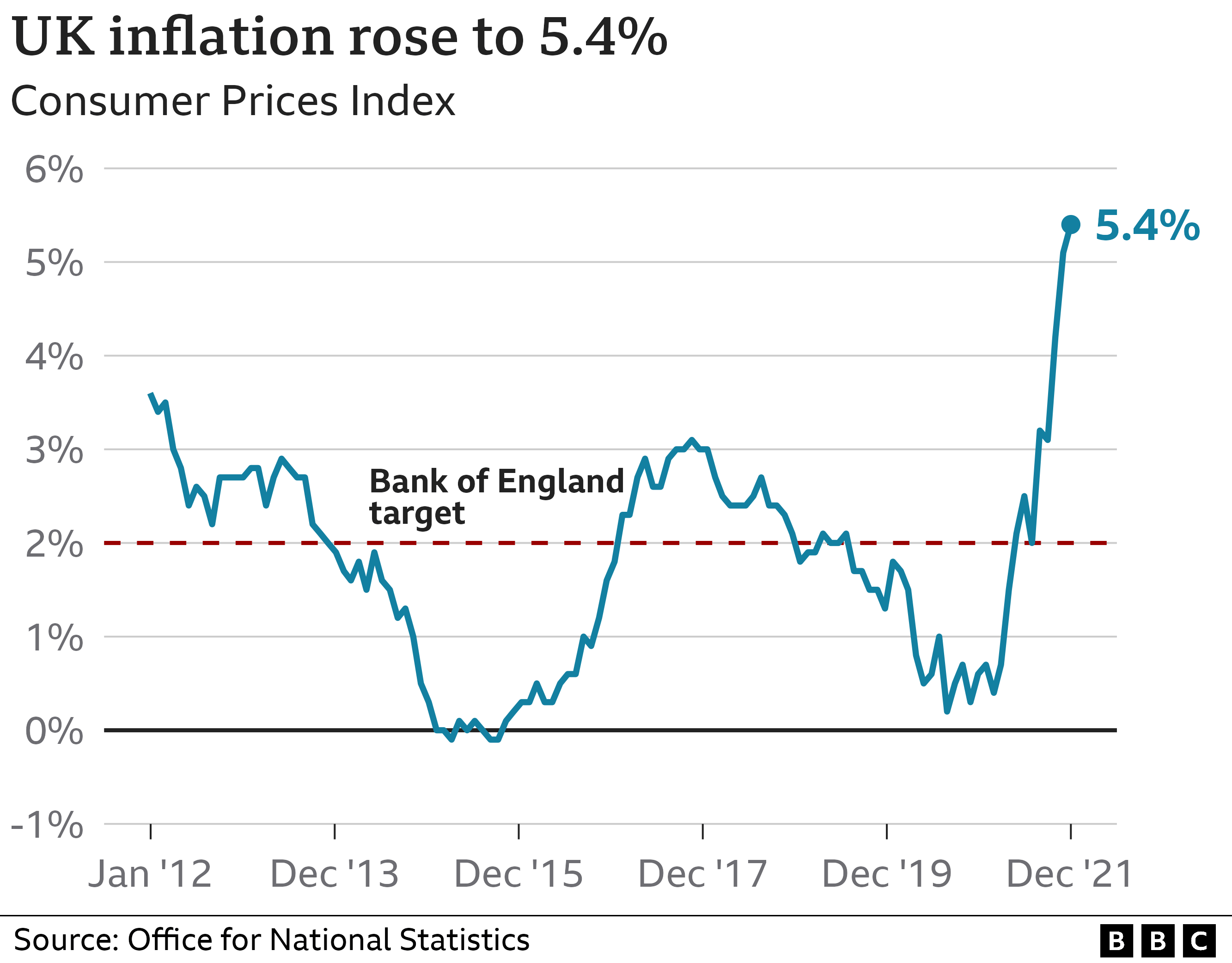

Soaring food costs and the energy bill crisis drove inflation to 5.4% in the 12 months to December, up from 5.1% the month before, in another blow to struggling families.

The last time inflation was higher was in March 1992, when it was 7.1%.

And with gas and electricity costs set to rise further in the spring, analysts predict it will reach that level again.

Households have seen their energy bills kept in check by the government's price cap, which limits the amount suppliers can charge, but this is due to be revised on 1 April.

As a result, fuel bills could increase by another 50% in the next few months, the energy industry has said.

'Alarming rise in food banks'

At the same time, there are signs that the high cost of food is proving too much for many people.

Richard Walker, boss of supermarket chain Iceland, said he was seeing an "alarming" rise in the use of food banks.

"There may be some people facing a choice between heating or eating. We're losing customers to hunger," he said.

He added that his stores served some of the UK's most deprived communities.

"Some of our customers only have £25 a week to spend on food, so they're already struggling to make ends meet," he said.

"When you have real wages falling, Universal Credit top-up withdrawal, food inflation, tax rises, that obviously will hit hard."

The latest rise was announced by the Office for National Statistics, which said increases in prices of furniture, food and clothing also contributed to December's rise in the cost of living..

Chancellor Rishi Sunak said he understood the pressures people were facing, but the opposition Labour party said working families faced an impending "triple whammy" of financial pressures.

The latest figures will increase pressure on the government, already under fire over tax rises set to take effect in April.

They will also fuel calls for the Bank of England to raise interest rates in a bid to dampen consumer spending and bring inflation closer to its 2% target.

https://www.bbc.com/news/business-60050699

(19, Jan 2022)

The information provided on this website is for reference only. C21 International shall not be liable for any errors, omissions, misstatements, or misrepresentations (express or implied), concerning any Information, and shall not have or accept any liability, obligation, or responsibility whatsoever for any loss, destruction, or damage (including without limitation consequential loss, destruction or damage) howsoever arising from or in respect of using, misusing, inability to use, or relying on the Information.